Experimental Proof of Concept

Insurance Agency Adoption of Robust Universal Address Data

This proof of concept is solely created to illustrate some of my design thinking as it could relate to the insurance industry. "TMRW Insurance" is a fictional company for this exercise. It contains many assumptions and high level ideas that would require further research to fully formulate. My goal is to show how a small upgrade to something like a data point could be used wisely and make a big impact. Wireframes best viewed on a desktop screen.

BACKGROUND

While working at my previous stop, Fubo Sportsbook, an important part of onboarding new bettors was "KYC" or "Know Your Customer". With strict industry regulations, a third party had to verify that the users are who they said they were, and located in a legal gambling state. Often times, misspellings and incorrect formatting of the ways users entered their street address would cause verification failures. So, we worked hard to implement a type-ahead address API to mitigate human entry errors.

As I was interviewing for a position in the insurance industry I noticed their customer sign up flow had the free form address fields. This made me ponder how collecting better address data could help the company and customer, and also other ways accurate address data can be utilized across an insurance organization.

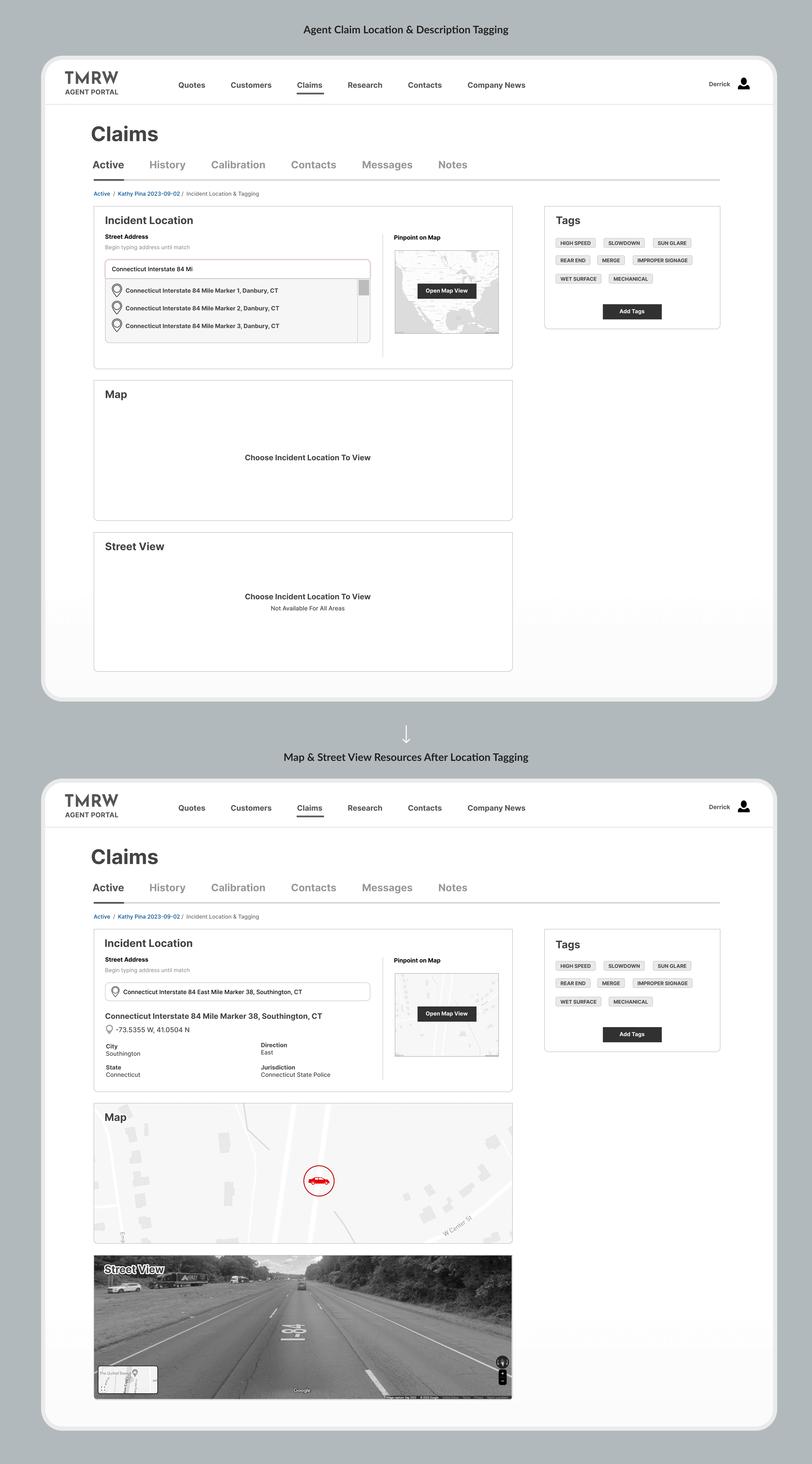

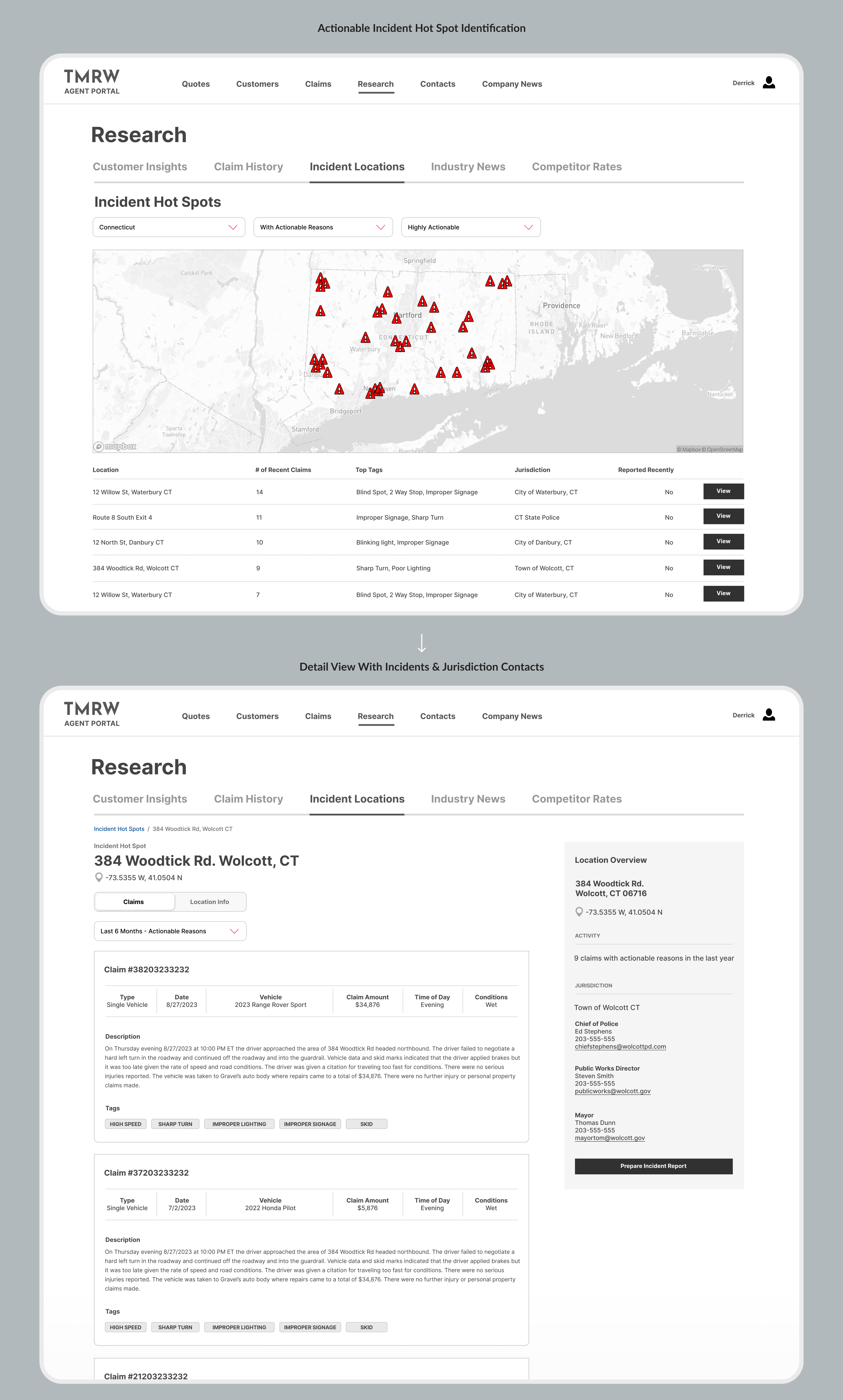

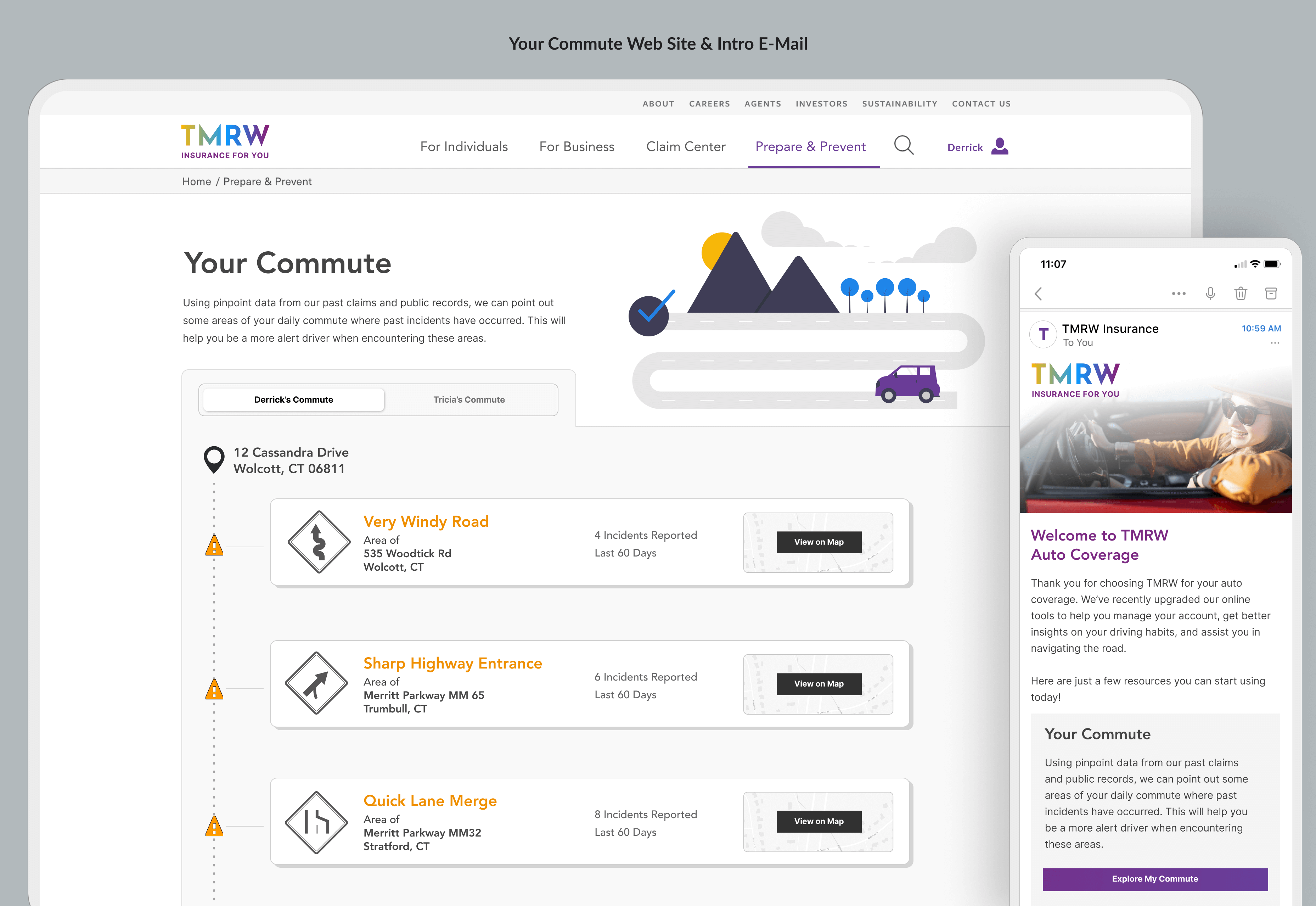

For this exercise I'm simulating that this company TMRW has had the opportunity to overhaul its backend and APIs, which will put them in a new position to better track customer's locations and accidents across the country. This new system could translate and store incidents received by both claimants and public data in an accurate, normalized format which contain address data, as well as geo-coordinates. These incidents could accurately be plotted on maps, searched by street, city, state etc, and can be cross referenced with accident data available from national, state, and local bureaus. In addition to the addresses, the new database could store notes and tags from the accident report as searchable entities.

Armed with the ability to better track accidents and where they occur, what can TMRW do with this information to improve their auto insurance business, to better protect themselves from exposure and also inform their valuable customers of potential hazards on the road?

Who potentially benefits from this new data?

Jennifer - Sales Agent

"I'm always looking to get the customer a better rate so they'll choose us over the competition. I also need to make sure I'm giving appropriate rates based on driving habits and other mitigating factors."

Sean - Risk Mitigation

"I need to ensure that TMRW is not always paying out claims for incidents that happen time after time on the same stretch of road. I work with deprtments of transportation to address trouble spots."